North News

Mumbai, December 6

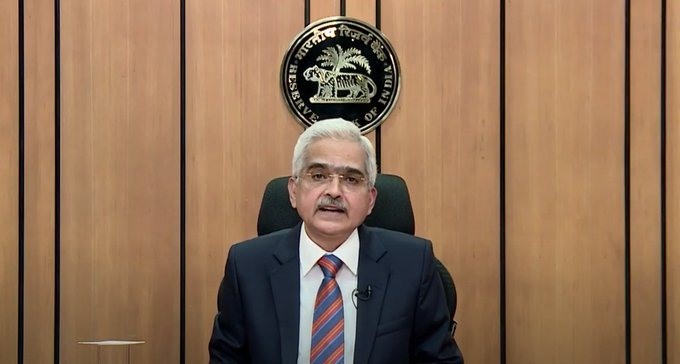

The Reserve Bank of India (RBI) has kept the repo rate steady at 6.5 percent for the 11th consecutive time, Governor Shaktikanta Das announced on Friday. As the global economy faces ongoing turbulence, Reserve Bank of India (RBI) Governor Shaktikanta Das reflected on 2024’s challenges, calling it a year that tested central banks’ ability to stabilize economies against complex and colossal shocks. Speaking after the Monetary Policy Committee (MPC) meeting held from December 4-6, Das highlighted the role of central banks in adapting to geopolitical conflicts, geoeconomic fragmentation, financial market volatility, and other uncertainties that continue to test global resilience.

The MPC decided, by a 4-2 majority, to keep the policy repo rate unchanged at 6.50%, with the standing deposit facility (SDF) rate at 6.25%, and the marginal standing facility (MSF) rate and Bank Rate at 6.75%. The committee unanimously opted to maintain a neutral stance, focusing on aligning inflation with the target while supporting economic growth.

Explaining the rationale for these decisions, Governor Das acknowledged a slowdown in India’s growth momentum, leading to a downward revision in the growth forecast. Real GDP growth in Q2 fell to 5.4%, significantly lower than anticipated, due to a decline in industrial growth, a contraction in mining activity, and subdued manufacturing performance. Despite these challenges, Das expressed optimism about India’s resilience and its ability to benefit from emerging global economic trends.

Inflation remains a significant concern, having surged above the upper tolerance band of 6.0% in October, driven by a sharp rise in food prices. The RBI projects food inflation pressures to persist through Q3 of FY2024-25, with relief expected from Q4, supported by seasonal corrections in vegetable prices, a robust kharif harvest, and adequate cereal buffer stocks. Governor Das warned that high inflation reduces disposable incomes, dampens private consumption, and negatively impacts GDP growth.

On the global front, Das observed that 2024 has been marked by unusual resilience despite multiple headwinds. Inflation is gradually declining from multi-decade highs, prompting some central banks to pivot policy directions. However, global trade remains confined within geopolitical blocs, and financial markets have faced volatility due to a strong US dollar and rising bond yields. Emerging markets, including India, experienced significant capital outflows, further complicating the economic outlook.

Looking ahead, Das emphasized the RBI’s commitment to balancing inflation control with growth. He stressed that durable price stability is essential for laying strong foundations for high economic growth. By maintaining the current repo rate and neutral monetary policy stance, the RBI aims to preserve flexibility to respond to evolving inflation and growth dynamics.

As India navigates these challenges, Das reaffirmed the central bank’s dedication to ensuring macroeconomic and financial stability, positioning the economy for sustained progress amidst global transformations.