North News

Mumbai, October 9

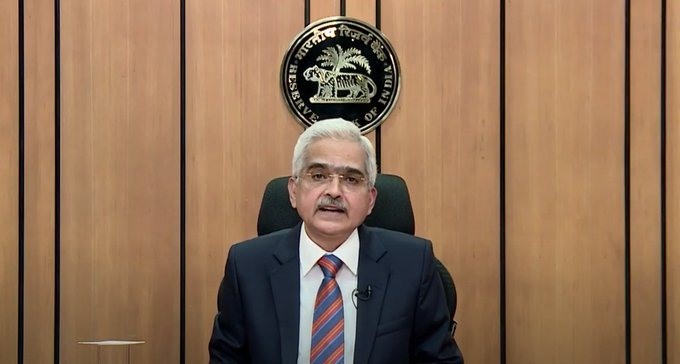

The Reserve Bank of India (RBI) decided to keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50%, following an assessment of the current macroeconomic situation. The RBI Monetary Policy Committee (MPC) also kept the standing deposit facility (SDF) rate at 6.25% and the marginal standing facility (MSF) rate and Bank Rate at 6.75%.

After its meeting, the MPC shifted its monetary policy stance to ‘neutral,’ while emphasizing its commitment to aligning inflation with the 4% target, within a tolerance band of +/- 2%, while supporting economic growth.

The RBI noted in an official statement that the global economy remains resilient despite risks from geopolitical tensions. In India, real GDP grew by 6.7% in Q1 of 2024-25, driven by private consumption and investment.

The central bank expects robust performance in the agriculture sector, supported by above-normal rainfall, and steady growth in manufacturing and services. Strong kharif sowing, along with sustained consumer spending during the festive season, bodes well for private consumption, while business confidence and investment outlook remain optimistic due to non-food bank credit growth and infrastructure investment.

Looking ahead, the RBI projects real GDP growth for 2024-25 at 7.2%, with quarter-wise estimates of 7.0% for Q2, 7.4% for Q3 and Q4, and 7.3% for Q1 of 2025-26. Inflation in July and August dropped to 3.6% and 3.7%, respectively, though the September figure is expected to rise due to base effects and food prices. Food inflation, however, is projected to ease by Q4 of 2024-25.