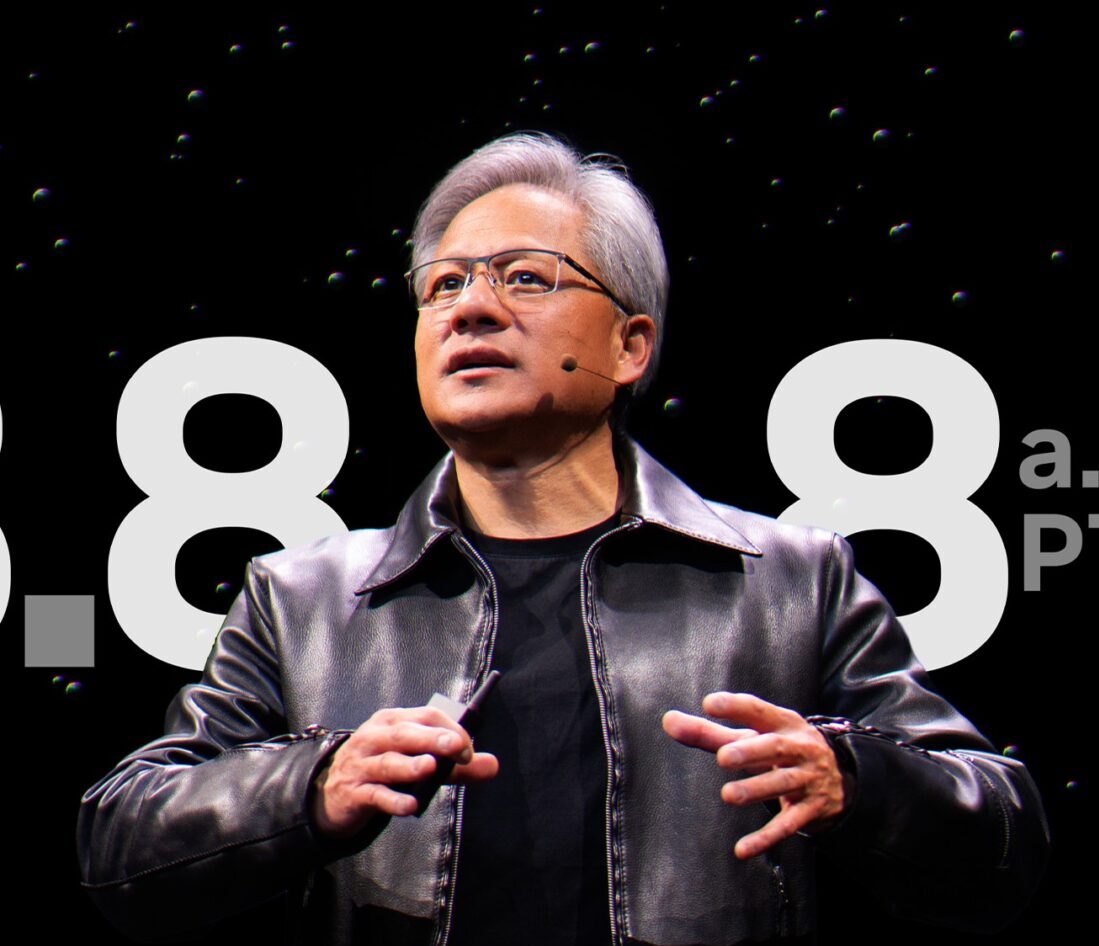

Nvidia Corp.’s recent three-day, $430 billion selloff has traders turning to technical analysis for clues on where the stock might find support. Nvidia shares have plummeted 13% since briefly overtaking Microsoft as the world’s most valuable company, pushing the stock into a technical correction for the first time since April.

Key Technical Levels

Traders are eyeing the $115 area for Nvidia shares, which aligns with a key Fibonacci retracement level. This level, roughly 2% below Monday’s closing price, marks the 38.2% retracement from the stock’s April low to its recent record high. Technical analysts use Fibonacci retracement to identify potential support or resistance lines.

Ari Wald, head of technical analysis at Oppenheimer, emphasizes the importance of the longer-term trend for Nvidia, which remains strong as the stock trades well above its 50-day moving average around $101 and 100-day moving average at $92. Wald suggests that significant tops usually form through a series of buying and selling phases before a momentum shift occurs.

Market Sentiment

Bruce Zaro, chief technical strategist at Granite Wealth Management, notes that for a stock in an uptrend like Nvidia, breaching the initial support level at $115 wouldn’t be alarming. However, a drop below $100 could signal increased volatility and caution in the short term.

Despite the recent downturn, the long-term uptrend for Nvidia appears intact, with analysts monitoring key support levels to gauge the stock’s future movements.