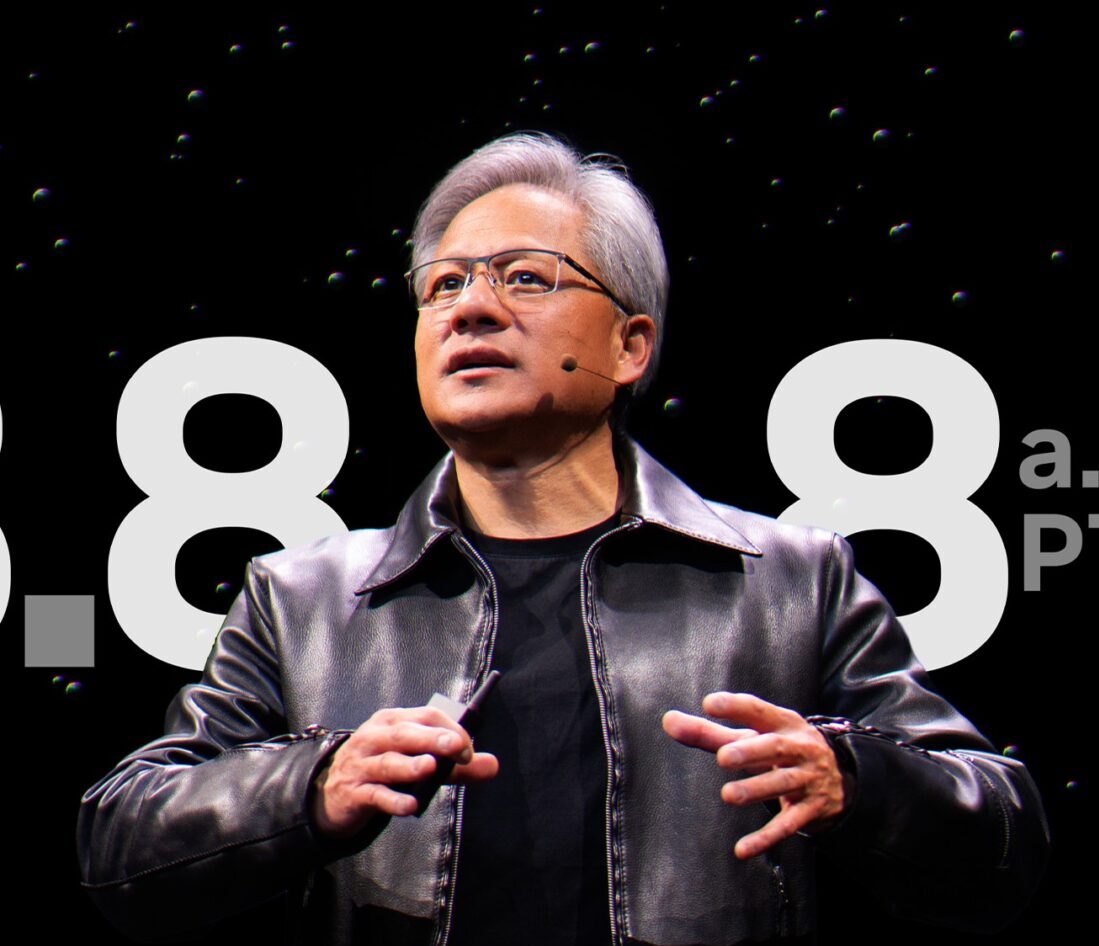

The world’s largest technology companies faced significant declines as tighter US restrictions on chip sales to China triggered a selloff in the industry. Major chipmakers like Nvidia, Advanced Micro Devices, and Broadcom were heavily impacted, leading to the worst plunge since 2020.

The Biden administration is considering severe curbs on companies like Tokyo Electron and ASML to prevent China from accessing advanced semiconductor technology. This news caused a notable downturn in semiconductor stocks, reflecting investor concerns about future sales and market stability.

Despite the overall negative trend, Intel and Globalfoundries managed to defy the selloff. Meanwhile, the Dow Jones Industrial Average reached another record, driven by strong performance in financial shares, notably U.S. Bancorp. The bond market remained relatively stable, and the Federal Reserve’s Beige Book reported slight economic growth and cooling inflation.

Governor Christopher Waller indicated that the Fed is getting closer to cutting rates, but not immediately. The yen saw significant gains, rising almost 1.5% among major currencies.

US companies are pushing for changes in export restrictions to China, which they feel have unfairly impacted them. Meanwhile, Donald Trump questioned the US’s duty to defend Taiwan, a key semiconductor manufacturing hub.

The tech sector’s recent underperformance comes after a strong first half of the year driven by megacaps. Analysts like Goldman Sachs’ Scott Rubner predict further declines, with historical data suggesting a downturn following mid-July.

Corporate highlights include Tesla’s plans for an autonomous taxi platform, Amazon’s marketing portal crash affecting major sales, and Morgan Stanley tapping the investment-grade market post-earnings. Johnson & Johnson reported strong second-quarter profits, beating Wall Street expectations.

High-Flying Chipmakers See Worst Plunge Since 2020: Markets Wrap