North News

Bengaluru, August 26

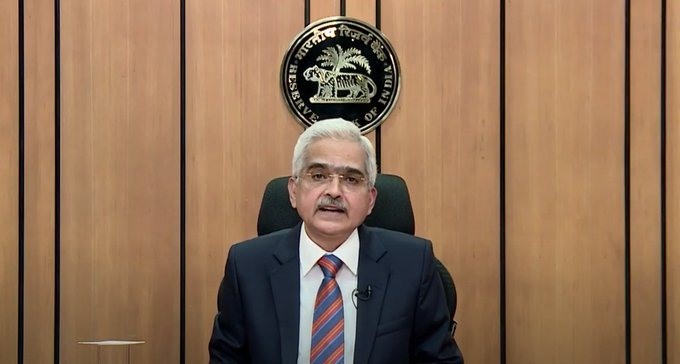

Reserve Bank of India(RBI) Governor Shaktikanta Das on Monday highlighted the transformative impact of Digital Public Infrastructure (DPI) on India’s financial inclusion, achieving in under a decade what would have otherwise taken several decades. He emphasized that DPI fosters market innovation by lowering transaction costs, expanding access, promoting competition through interoperability, and attracting private investment. During crises like the COVID-19 pandemic, India and a few other countries effectively utilized digital infrastructure for vaccination programs and targeted financial aid.

RBI Governor Das elaborated on India’s unique DPI model, where the foundational infrastructure is developed and managed by the public sector, while the private sector leverages it to create innovative customer-facing services. He pointed out that the public sector’s role in developing DPI is crucial, as the private sector may hesitate to invest in infrastructure with uncertain returns. Moreover, private infrastructure may not support democratized access or interoperability, whereas India’s approach ensures competitiveness in the open market.

Focusing on finance, the RBI Governor identified key DPI components, including digital payments, digital currency, digital identity, and digital processes. He explained that India’s DPI strategy is centered on three pillars: digital identity, bank accounts, and processing infrastructure. The Aadhaar system, which has generated nearly 1.4 billion biometric identities, offers universal proof of identity for Indian residents. The Jan Dhan scheme, aimed at the unbanked population, has opened over half a billion Basic Savings Bank Deposit (BSBD) accounts.

RBI Governor Das further noted that India’s processing infrastructure has been strengthened through the widespread availability of affordable mobile phones and internet. As of May 2024, India has around 0.9 billion mobile internet users, with a mobile tele-density of 83%, and even rural areas showing a tele-density of 60%. The JAM trinity—Jan Dhan Accounts, Aadhaar, and Mobile Phones—forms the backbone of India’s DPI, facilitating a wide range of value-added services. Notably, over 67% of JAM beneficiaries are from rural areas, and more than 55% are women, underscoring DPI’s role in promoting financial inclusion.