North News

Mumbai, August 8

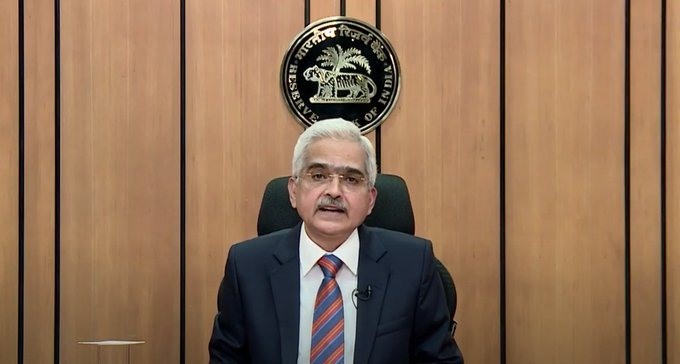

In a significant decision, the Reserve Bank of India on Thursday kept the benchmark interest rate unchanged for the ninth time in a row at 6.5 per cent. Giving details, RBI Governor Shaktikanta Das said that inflation is broadly on a declining trajectory and the RBI had decided to continue with withdrawal of the accommodative monetary policy stance.

Providing details about the assessment and outlook in an official statement, the RBI said that the global economic outlook remains resilient although with some moderation in pace and Inflation is retreating in major economies but services price inflation persists.

The RBI further said that international prices of food, energy and base metals have eased since the last policy meeting. “With varying growth-inflation prospects, central banks are diverging in their policy paths. This is creating volatility in financial markets. Amidst recent global sell offs in equities, the dollar index has weakened, sovereign bond yields have eased sharply and gold prices have soared to record highs,” the RBI said.

Talking about the domestic economic activity, the RBI said that the domestic economic activity continues to sustain its momentum. After a weak and delayed start, the cumulative southwest monsoon rainfall has picked up with improving spatial spread. “By August 7, 2024, it was 7 per cent above the long period average. This has supported kharif sowing, with total area sown as on August 2, being 2.9 per cent higher than a year ago. Industrial output registered an expansion of 5.9 per cent (y-o-y) in May 2024,” the RBI added.

Providing details about the industry, the RBI said that core industries rose by 4.0 per cent in June, against 6.4 per cent in May and other high frequency indicators released during June-July 2024 indicate expansion of services sector activity, ongoing revival of private consumption, and signs of pickup in private investment activity. “Merchandise exports, non-oil non-gold imports, services exports and imports expanded during April-June,” the RBI added.

The RBI said that going forward, the Indian Meteorological Department’s (IMD) projection of above normal southwest monsoon and healthy kharif sowing will support improving rural demand.

“The sustained momentum in manufacturing and services suggests steady urban demand. High frequency indicators of investment activity as evident in strong expansion in steel consumption, high capacity utilisation, healthy balance sheets of banks and corporates, and the Government’s continued thrust on infrastructure spending, point to a robust outlook. Improving world trade prospects could support external demand. Headwinds from geopolitical tensions, volatility in international commodity prices and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2024-25 is projected at 7.2 per cent with Q1 at 7.1 per cent; Q2 at 7.2 per cent; Q3 at 7.3 per cent; and Q4 at 7.2 per cent. Real GDP growth for Q1:2025-26 is projected at 7.2 per cent. The risks are evenly balanced,” he added.